colorado electric vehicle tax credit 2019

Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in. Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles.

Plug In Electric Vehicle Policy Center For American Progress

State-level tax data reveal similar disparities in Colorado.

. The Colorado Secretary of State SOS published this rule on September 10 2019. At least 50 of the qualified vehicles miles must be driven in the state and the credit expires at the end of 2020. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

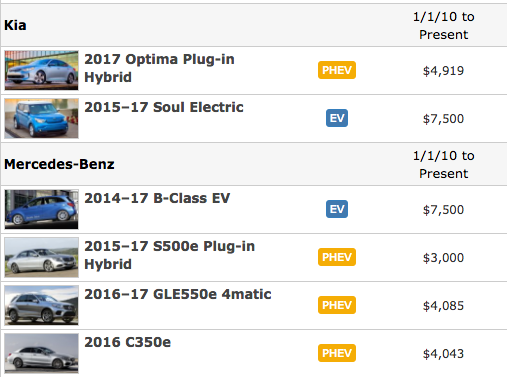

Purchases through 2023 qualify for a tax credit between 2500 to 10000 and then drop to 2000 to 8000 before expiring. The credit ranges between 2500 and 7500 depending on the capacity of the battery. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits.

Federal tax credits of up to 7500 are still available for most EVs though Tesla met its max at the end of last year and General Motors phases out by April. As of January 2 2022 automakers must make an increasing minimum percentage of Zero Emission Vehicles ZEVs available for sale as part of their light-duty fleet 8500 pounds GVWR. Light-duty PEVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

Alongside a federal tax credit of 7500 Colorado residents are able to claim an additional state credit of 5000 at point of sale when they buy an EV. Information about Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file. 2500 in state tax credits and up to 7500 in federal tax credits.

1500 for 2-year minimum leases. For additional information consult a dealership or this Legislative Council Staff Issue Brief. Examples of electric vehicles include.

Why buy an Electric Vehicle. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche Taycan and Jaguar I-Pace amongst others. 2500 credit received with state income tax refund may be applied at purchase with many electric vehicle manufacturers.

Are there federal tax credits for new all-electric and plug-in hybrid vehiclesThis link will provide you an update by car manufacturer. Social Security Number. Innovative Motor Vehicle Credit.

750 rebate available for new or certain used Electric Vehicles with a final purchase price of 50000 or lower Additional 1000 available for low income applicants Solar. Alongside a federal tax credit of 7500 Colorado residents are able to claim an additional state credit of. Unused tax credit can be rolled forward to future years.

The alternate rule provides automakers with proportional andor early-action. The credit is worth up to 5000 for passenger vehicles and more for trucks. Check em all out and map your route.

House Bill 1159 Extends income tax credit incentive on the purchase or lease of an electric vehicle or plug-in hybrid electric to 2026. From 2017 to 2020 more than 12000 households received a state tax credit to purchase a plug-in electric vehicle. Fiscal Policy Taxes.

This includes all Tesla models and Bolts that do not receive the Federal tax incentive. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. EV charging stations are being rapidly installed throughout our state and country.

Earned Income Tax Credit EITC Colorado Earned Income Tax Credit Expanded Colorado Earned Income Tax Credit. As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. Colorados credit for new EV purchases dropped to 4000 in January and will be reduced again next year.

The tax credit for most innovative fuel. A number of bills affecting electric vehicle adoption in Colorado were considered during the 2019 session. Income tax - credit - innovative motor vehicles.

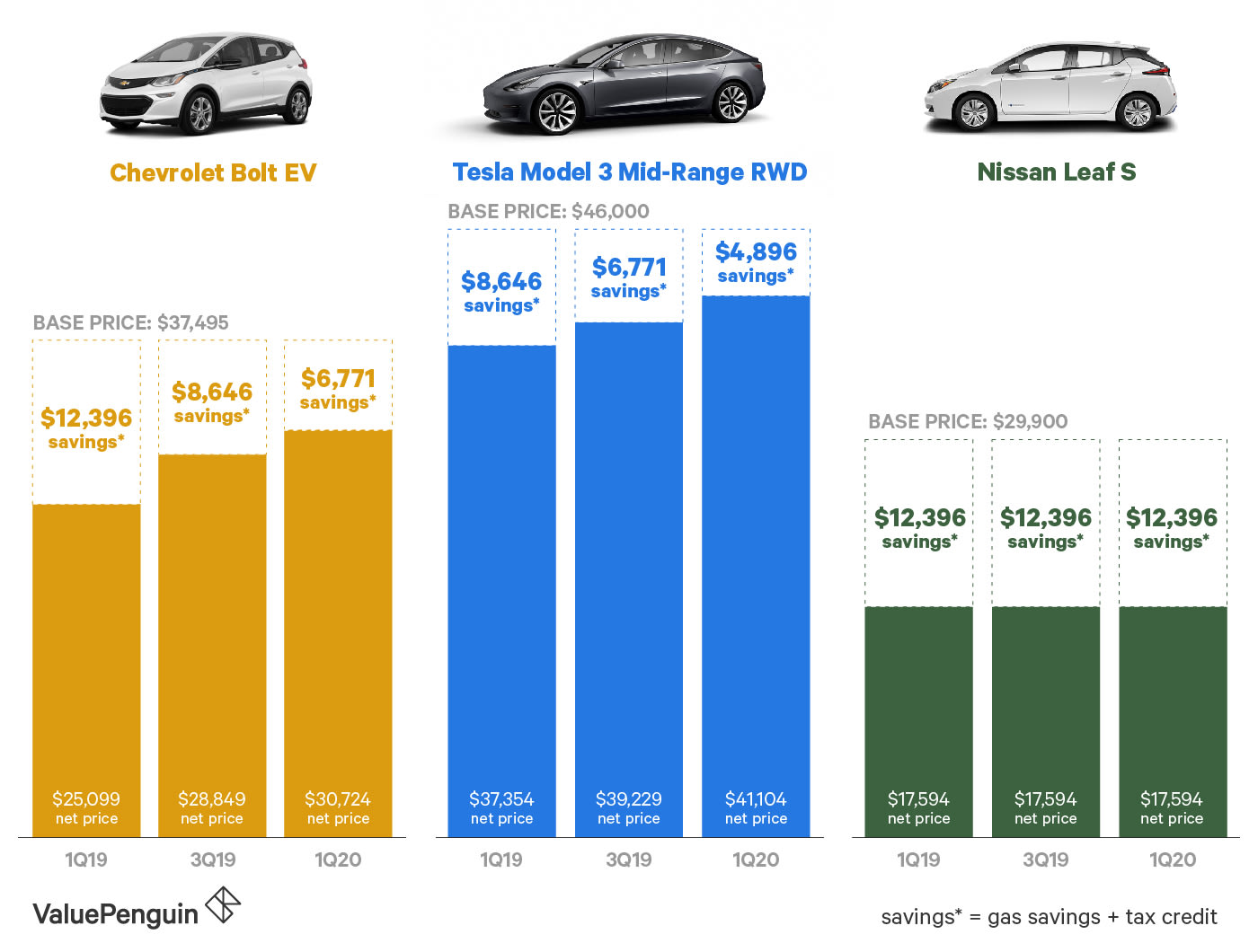

Together these incentives significantly reduce the cost of buying an electric vehicle more than 40 percent in some cases. The act modifies the amounts of and extends the number of available years of the existing income tax credits for the purchase or lease of an electric motor vehicle a plug-in hybrid electric motor vehicle and an original equipment manufacturer electric truck. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25.

Skip the Gas Station. Qualified PEVs titled and registered in Colorado are eligible for a tax credit. Plug-In Electric Vehicle PEV Tax Credit.

Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. But theres one thing in decline the tax credits available to new electric-car buyers. Earn 90 per kW off the cash or loan price of solar panels and 70 per kW off the cash or loan price of Solar Roof by trading your Solar Renewable Energy Credits SREC filed on behalf of the customer.

Innovative Motor Vehicle Credit Form DR 0617 DONOTSEND DR 0617 071321 COLORADO DEPARTMENT OF REVENUE TaxColoradogov Innovative Motor Vehicle Credit and Innovative Truck Credit Tax Year 2021 Instructions Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor. The Colorado General Assemblys 2019 and 2021 legislative sessions were monumental for climate and. Under the bill the tax credit for a passenger electric or plug-in hybrid vehicle would drop from the current 5000 after the first year to 4000 and end at 2500.

Is not dependent upon the growth in general fund revenues and will continue to be available after 2019. In addition to cutting-edge technology and performance state and federal tax credits are helping to make buying an electric vehicle EV an even smarter choice. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

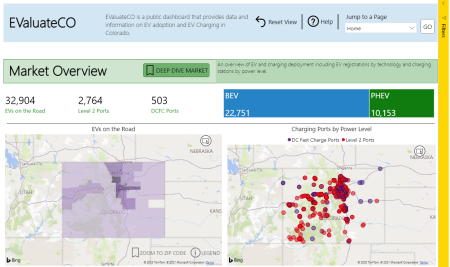

Credit for Buying a Hybrid. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. To accelerate the electrification of cars buses trucks and other vehicles in Colorado the state set a goal of 940000 electric vehicles on the road by 2030Governor Jared Polis issued an Executive Order Supporting a Transition to Zero Emission Vehicles in January 2019.

Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a vehicles power source with an alternative fuel power source.

How Do Electric Car Tax Credits Work Credit Karma

Don T Miss Out On Electric Car Tax Benefit Deadlines Valuepenguin

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Zero Emission Vehicle Tax Credits Colorado Energy Office

Rebates And Tax Credits For Electric Vehicle Charging Stations